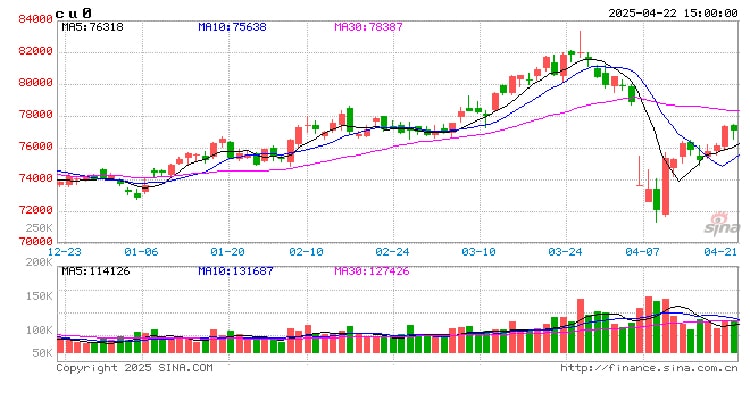

SHFE copper main contract rose by 0.41% to RMB 76,760/ton, while LME remained closed overnight. Growing concerns over a potential U.S. economic slowdown are mounting, with former President Trump urging the Fed to cut interest rates, citing negligible domestic inflation. Fears over U.S. debt repayments in Q2, compounded by tariff uncertainties, triggered a sharp sell-off in U.S. assets, boosting global risk aversion. On the supply side, China’s major copper inventory dropped by 36,900 tons to 196,500 tons, significantly lower than the same period last year. Downstream operations and order levels remained stable, but tightening supply in March—refined copper, scrap, and anode copper—all declined, leading to persistent spot premiums. Despite a technical rebound, copper prices face upside limits amid macro uncertainties. Market focus remains on the 78,000–80,000 RMB/ton resistance level and the performance of LME copper during non-Asian trading hours.

SHFE nickel fell 0.18% to RMB 125,200/ton. SHFE inventory rose by 229 tons to 25,320 tons. LME spreads remain in contango, while imported nickel premium fell by RMB 75/ton to RMB 150/ton. While nickel ore prices showed slight weekly increases, domestic NPI prices trended lower, with Tsingshan’s latest high-grade NPI bid at RMB 970/ni (delivered, tax included, Ni 10-12%). In stainless steel, weaker support from raw material prices and structural stock increases led to price consolidation. In the new energy sector, a recent accident in an Indonesian industrial park tightened short-term MHP supply, propping up nickel sulfate costs. Despite a rebound in ternary precursor output, market sentiment remains cautious. Primary nickel inventories continued building domestically and overseas. While nickel prices are recovering, mounting resistance and global policy risks warrant close attention to inventory trends.

Alumina prices strengthened slightly, with the AO2505 contract closing at RMB 2,830/ton (+0.35%). SHFE aluminum fluctuated, with the AL2506 contract ending at RMB 19,815/ton (+0.2%). Spot alumina rose to RMB 2,870/ton, while aluminum ingot spot premiums expanded to RMB 60/ton. Regional price variations persisted, with Foshan A00 at RMB 19,870/ton and Wuxi A00 showing an RMB 80/ton discount. Processing fees for aluminum rods increased, while some low-carbon products saw declines. Though alumina maintenance expanded, shorter downtimes limited the impact on oversupply. Xinjiang logistics disruptions and downstream restocking drove aluminum inventory drawdowns to a yearly high. Still, the expected seasonal demand slowdown looms. As China enters a phase of tariff policy adjustment, aluminum prices are likely to remain range-bound. Traders are advised to adopt a high-sell, low-buy strategy within the defined range.

Polysilicon futures continued their uptrend, with the 2506 contract rising 1.35% to RMB 38,420/ton. Spot N-type silicon rose to RMB 42,000/ton, widening its premium over futures to RMB 3,580/ton. Industrial silicon also showed mild strength, with the 2505 contract up 0.34% to RMB 8,860/ton. However, spot prices dropped by RMB 28/ton to RMB 10,225/ton. Supply-side reductions are expanding—Yili will halt production in May, and resumption in Southwest China has been delayed. Some plants are shifting to ferroalloys due to sustained losses. Despite ongoing production cuts, the pace lags behind the price correction, signaling further downside. Weak end-user demand in polysilicon is also intensifying bearish sentiment. Continued structural imbalance suggests a cautious outlook, with attention needed on inventory inflection points and policy changes before the delivery month.

The 2507 lithium carbonate contract dropped 1.54% to RMB 69,000/ton. Spot battery-grade lithium prices fell RMB 600/ton to RMB 70,850/ton, and industrial-grade dropped RMB 550/ton to RMB 69,100/ton. Lithium hydroxide prices also declined slightly. SHFE warehouse stocks increased by 883 tons to 30,445 tons. In March 2025, China’s lithium spodumene imports reached 534,500 tons, down 5.8% MoM. Imports from Australia increased, while those from South Africa, Zimbabwe, and Nigeria showed significant declines. Lithium carbonate imports rose 47.0% MoM to 18,100 tons, led by imports from Chile and Argentina. On the supply side, weekly domestic output declined by 574 tons to 17,388 tons, mostly from spodumene. April output is estimated at 80,000 tons, with a 4% rise in daily production. Downstream demand (ternary + LFP cathodes) saw a 5% uptick, with declining inventory turnover days. Yet, concerns remain over weak demand and insufficient supply cuts. Without new bullish drivers, the market may continue weak consolidation. Focus should be on upstream production cuts, inventory levels, and lithium ore price trends.