The tinplate packaging industry in Western Europe is on a promising growth trajectory, with market value estimated at USD 683.2 million in 2024, and projected to reach USD 936.8 million by 2032, according to the latest market intelligence reports. This expansion is primarily fueled by rising demand from food and beverage manufacturers, increasing environmental regulations, and consumer preference for sustainable packaging solutions.

Tinplate, a thin steel sheet coated with tin, is gaining favor due to its recyclability, corrosion resistance, and durability. The packaging material supports Europe’s push for a low-carbon, circular economy, offering advantages over plastic alternatives. With governments tightening packaging waste regulations—especially under EU’s Packaging and Packaging Waste Regulation (PPWR)—brands are switching to metal containers for both compliance and brand value enhancement.

| Metric | 2024 Estimate | 2032 Projection | CAGR (2024–2032) |

|---|---|---|---|

| Market Size (USD) | $683.2 million | $936.8 million | 4.6% |

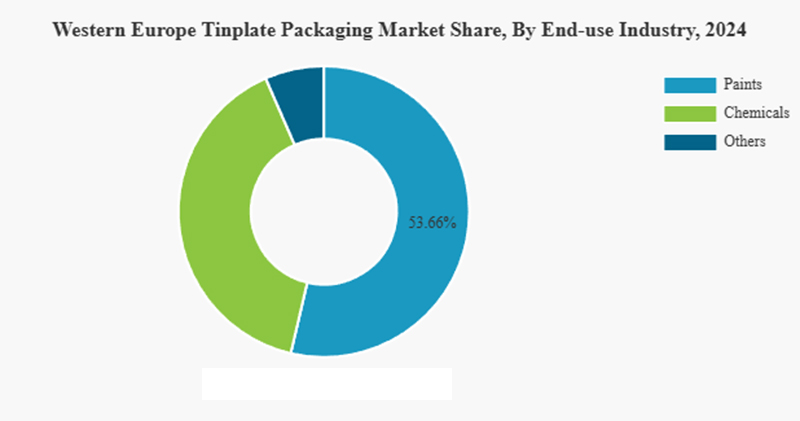

| Dominant End-Use Sector | Food & Beverage | Food & Beverage | – |

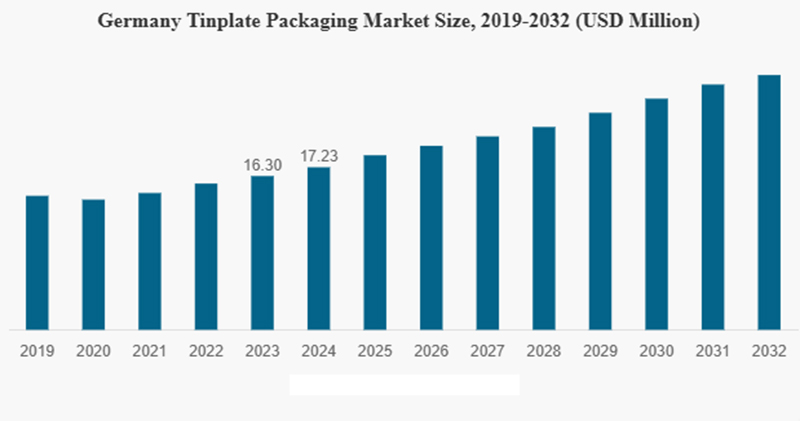

| Leading Country Contributor | Germany | Germany | – |

Germany remains the market leader in Western Europe due to its strong industrial base, commitment to sustainable practices, and advanced recycling infrastructure.

Consumers are increasingly aware of environmental issues, driving demand for sustainable and recyclable packaging. Tinplate offers nearly 100% recycling capability, making it a preferred material across Western Europe.

Food-grade tinplate provides superior preservation, extending shelf life and preventing contamination. The need for long-term storage—especially post-pandemic—has made metal packaging a strategic choice.

Recent innovations in printing, coating, and shaping tinplate have made it more versatile and cost-effective. Custom designed tin packaging now appeal to premium food, coffee, and cosmetics brands.

Several major companies are actively shaping the Western European tinplate landscape:

ArcelorMittal

Thyssenkrupp Rasselstein

Tata Steel Europe

Trivium Packaging

Massilly Group

These companies are investing in green production technologies and forming partnerships with FMCG brands to deliver tailored, high-performance packaging.

With robust market fundamentals and mounting regulatory support for sustainable materials, tinplate packaging in Western Europe is poised for steady growth. Companies that invest in eco-friendly innovations and adapt to shifting consumer preferences will have the competitive edge in the years ahead.